Since online sports betting was legalized in Colorado in 2020, the state has generated millions in tax revenue. Over the years, revenue has increased. Between 2022 and 2023, it doubled. For the 2025 fiscal year to date, Colorado has collected more than $24.5 million, which is a 19% increase over the previous year. With the majority of betting taking place online, sportsbooks continue to be a major source of tax revenue for the state. Here at Colorado Betting Hub, we examine the revenue and taxes generated by online wagering.

Latest Colorado Betting Numbers (July 2025)

The latest revenue data available for Colorado comes from the month of July. In total, sports wagers in the state totaled $352.3 million. The gross revenue generated was $35.5 million, and there is a 10% tax rate.

State revenue reports are conducted monthly, though the information is not released immediately. It can take 4 to 5 weeks after the month’s end to get the revenue reports from the Colorado Division of Gaming. This is why we are using data from July to show the current betting numbers. Once the state releases data, we will update the numbers accordingly.

Monthly Revenue Breakdown

| Month | Gross Revenue |

|---|---|

|

July 2025 |

$35.5 million |

|

June 2025 |

$38.8 million |

|

May 2025 |

$49 million |

|

April 2025 |

$47.3 million |

|

March 2025 |

$36.2 million |

The amount of revenue largely depends on what sports are in season. You can see that there was more revenue generated during April and May, which is when key events take place, including March Madness, the start of the MLB season, and the NBA playoffs. With the Denver Nuggets and Colorado Rockies being two of the favorite teams, betting revenue increases when popular sports are being played.

Handle (Total Amount Bet)

The July 2025 report provides information on the handle, which is the total amount that is bet. Online sportsbooks have received over $352 million in bets during the month of July. In June, the handle was $372 million. May and April were both high-betting months. In May, Colorado bettors wagered $495 million, while in April, the handle was over $507 million.

Revenue (Sportsbook Winnings)

The Colorado Division of Gaming also releases information on the gross revenue and the hold percentage. The hold percentage represents the amount of money kept by sportsbooks after bets have been placed. This rate changes every month and is widely dependent on current major sporting events.

In July, the gross revenue was $35.5 million with a 10.1% hold. This is a reduction from June, when the GR was nearly $40 million with a 10.7% hold.

Tax Revenue Generated

In July, online sports betting generated $2.7 million in taxes. This was a slight decrease from the previous month’s collected tax of $3.1 million. From the start of the year, online betting sites in the state have taken in $22.8 million in state taxes.

Tax revenue is used for funding the Colorado Water Plan. Annual tax revenue is used for conservation efforts and to protect natural water sources. While the majority of funds are allocated to the Water Plan, some are used for addiction services and responsible gambling resources.

Historical Revenue Trends

Peak months for sports betting in Colorado are during the NBA, NFL, and NHL seasons. Betting often slows during the summer. Even with MLB betting available, that one major sport does not carry the weight.

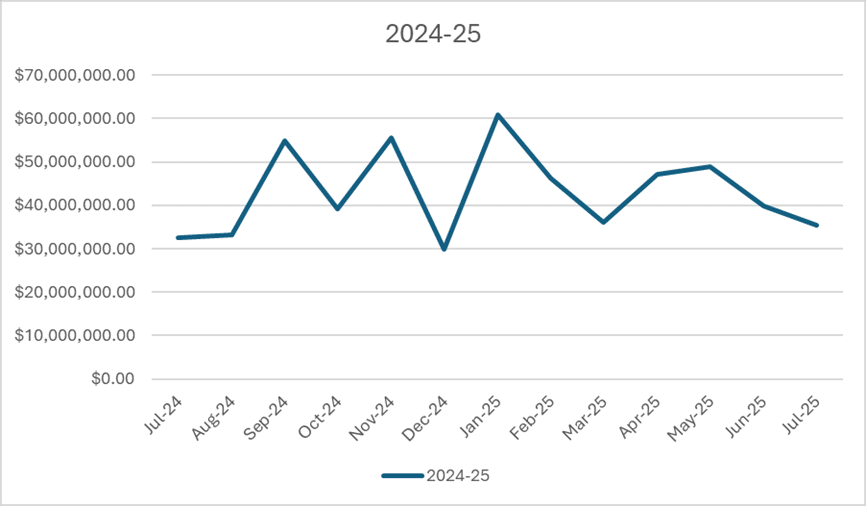

The chart below shows how the amount of revenue fluctuated over the past year. The NFL season remains the peak time for bettors, with the majority of wagers being placed on regular games and the Super Bowl.

Best and Worst Months

During the fall, when the Broncos, Nuggets, and Avalanche all start playing, there is an increase in activity. September through March remains a busy betting season. Football wagers account for the majority of the bets being placed in Colorado.

June, July, and August tend to have the lowest amount of activity due to fewer professional sporting events. In the past year, January saw the highest revenue, with $60.9 million generated. The lowest was the following month. In February 2025, Colorado only generated $25 million in gross revenue.

Growth Since Launch (May 2020)

The sports betting market in Colorado has been very successful since launching in May 2020. The state has seen record-breaking wagering amounts, massive amounts of tax revenue, and an increase in new online bettors.

The market growth trajectory is still on the rise. During the latest fiscal year, $6.3 billion was wagered, which represented a 130% increase over the previous year.

- Total handle since launch: $25.4 billion

- Total tax revenue collected: $116.5 million

Colorado vs Other States

Arizona, Kansas, and Wyoming are the three neighboring states that offer legal online betting. We have compared the handle, revenue, and tax rate numbers in the chart below. Based on these numbers, Colorado remains one of the leading states in the US when it comes to the generation of revenue. Ranked 6th in the US market, Colorado continues on an upward trend, attracting new customers on a regular basis. The state is also home to 25 licensed online sportsbooks, which is a larger number than in nearby states.

| CO Nearby States | Arizona | Kansas | Wyoming |

| Handle | $2.3 billion | $6.9 billion | $64 million |

| Revenue | $200 million | $632 million | $5.8 million |

| Tax Rate | 10% | 10% | 10% |

Sports Breakdown

Colorado is home to some excellent professional sports teams. NFL fans will be supporting the Denver Broncos during the season, while basketball fans root for the Nuggets. Basketball and football are the two top sports for betting in the state. This is followed by Major League Baseball, Tennis, and soccer.

The list below breaks down the percentages of bets that are placed on these five popular sports.

- NBA – 33%

- NFL – 18.2%

- MLB – 17%

- Tennis – 10.8%

- MLS – 7%

Online vs Retail Betting

When legal sports betting was launched in Colorado, it quickly became the preferred way to wager. Since the launch of sites, online betting has accounted for 99% of all wagers placed. In January of 2024, CO residents wagered over $493 million compared to just $3 million wagered at retail locations. Bettors in the state favor wagering online due to the access, speed, and special offers.

Online betting sites are also more prominent. There are over 25 operating online sportsbooks in the state and just 8 retail locations. All retail locations are located in Black Hawk, Cripple Creek, and Central City. Most retail sportsbooks are in Black Hawk, with Cripple Creek and Central City each having just one location.

The most popular retail betting locations include:

- Bally’s Arapahoe Park in Aurora, CO

- Bally’s Black Hawk in Black Hawk, CO

- Grand Z Casino in Central City, CO

- Saratoga Casino in Black Hawk, CO

- Wildwood Hotel and Casino in Cripple Creek, CO

With many more options for betting online, Colorado sports fans have a great array of choices. All of the operating sportsbooks in the state take a mobile-first approach. Apps can be used on different devices, and many sites do not require any download to wager using a mobile device.

Top Sportsbooks by Market Share

The data regarding market share in Colorado is held by each sportsbook. Annual and monthly reports from the Colorado Division of Gaming do not include current market share percentages. However, sportsbook market share in Colorado is on par with the national numbers.

At the end of 2023, FanDuel held 41.5% of the market based on revenue in the US. DraftKings followed with 32%. BetMGM came in with 9.9% and Caesars with 6%. ESPN Bet, while popular in Colorado, only held 3% of the market share.

Where Colorado Betting Tax Revenue Goes

The tax that is generated by online betting is used for various things. Based on current Colorado laws, 10% of the revenue is allotted to the Division of Gaming to cover any administrative costs. Of the remaining funds, 6% is then in a hold harmless fund.

This money is distributed to the operating casinos as a way to compensate for any revenue losses resulting from the legalization of sports wagering. All remaining revenue is transferred to the Water Plan. It is then distributed for management projects and conservation.

Changes to the current law go into effect beginning the fiscal year 2026. At this time, 5% of sports betting revenue will be given to the Problem Gambling Fund. This helps to educate bettors on the harm of problem gambling and to provide treatment efforts.

Frequently Asked Questions

When is Colorado betting data released?

The monthly reports on revenue and betting handle are released by the DOR’s Division of Gaming. The release of information will be available in 4-5 weeks after the end of every month.

How much tax does Colorado collect?

The sports betting tax in Colorado is 10%, which applies to the proceeds generated by each licensed sportsbook. During July 2025, the tax collected was $2.7 million, and for the year, Colorado has collected $22.8 million.

What’s the difference between handle and revenue?

Handle is the amount of money that is bet at sportsbooks. If bettors wager $1 million on the World Series, the total handle is $1 million. Revenue is the amount of money kept by the betting sites after all winnings have been paid. If the handle remains $1 million and the sportsbook pays out $900,000, the revenue is $100,000.

Which sportsbook is biggest in Colorado?

FanDuel and DraftKings are the two biggest operators in Colorado. Combined, these two hold nearly 70% of the market share. BetMGM is the third biggest in the state with an 8% market share.

Where does the tax money go?

The majority of tax money collected from sports betting is used to fund the Water Plan. 75% of funds are used for the Plan, while the remaining 25% is divided between the Division of Gaming and a hold harmless fund.